nys workers comp taxes

Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of 114400 for rating their overall workers compensation cost. Workers compensation is an insurance program for employers which is mandated under state law.

Is Workers Compensation Taxable In North Carolina Riddle Brantley

New York State Workers Compensation Board.

. Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny. Do you claim workers comp on taxes the answer is no. Is workers comp taxable in NYS for either State or Federal.

Workers Comp Exemptions in New York. NYSIF expects to begin to offer out-of-state coverage beginning in the summer of 2022. So in most cases you dont have to worry.

Failure to comply with state workers compensation insurance rules can result in serious penalties and other liabilities. Get information on medical benefits and help finding a provider. If you withhold less than 700 during a calendar quarter pay the tax with your Form NYS-45.

Copy A along with Form W-3 goes to the Social Security Administration. 20 Park Street Albany NY 12207 518-474-6670. It increases to 3 in 2020 then to 5 in 2021.

The IRS manual reads. You retire due to your occupational sickness. The following payments are not taxable.

The estimated employer rate for workers compensation insurance in New York is 07 per 100 in payroll for the lowest risk jobs and 2993 per 100 in payroll for the. Employers may also be required to. Also under IRS regulations non-taxable workers compensation-related benefits are not eligible for salary deferral under the New York State Deferred Compensation Plan NYSDCP.

In New York state law requires employers to cover all employees with workers compensation and disability insurance. Generally workers comp payments are not taxable income. In that sense workers comp is in the same.

However there is one exception. Every domestic foreign or alien insurance corporation taxable under Article 33 that does business employs capital owns or leases property or maintains an office in the Metropolitan Commuter Transportation District includes the counties of New York Bronx Queens Kings Richmond Dutchess Nassau Orange Putnam Rockland Suffolk and Westchester shall. Workers comp benefits are non-taxable insurance settlements.

Workers compensation benefits for work injuries are tax-exempt if they are paid under the workers compensation act and also includes the survivors that receive benefits for fatal injuries. Generally the Internal Revenue Service IRS does not consider NY workers compensation benefits to be taxable income. The quick answer is that generally workers compensation benefits are not taxable.

Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law. While a worker does need to report these benefits on New York tax form W-2 Wage and Tax Statements the amount awarded by the New York State Workers Compensation Board is excluded from. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

- Answered by a verified Tax Professional. As a general rule workers compensation benefits are not taxable. Workers compensation benefits are not considered taxable income at the federal state and local levels.

Filing requirements NYS-45 NYS-1 Filing methods. If you withhold New York State New York City or Yonkers income tax from your employees wages you must report it quarterly on Form NYS-45. Even if youre a freelancer or sole proprietor and work alone you need to be in the know about.

In most cases they wont pay taxes on workers comp benefits. Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors. You are responsible to pay the amount you withhold to the Tax Department as follows.

If you are also receiving Supplemental Security Income SSI or Social Security Disability Insurance SSDI benefits a portion of your workers compensation may be taxable income. The money you receive from your compensation claim is not taxable on either the state or federal level whether you receive monthly payments or obtained a lump sum settlement. Ask Your Own Tax Question.

Typically in New York workers that receive benefits from workers compensation due to an on the job injury are not subjected to taxes at the federal state or local levels. When injured Worker A receives 1000 a month in SSDI benefits and another 800 in workers comp. The short answer to whether or not workers compensation benefits are taxable is quite simply no.

However retirement plan benefits are taxable if either of these apply. Do you claim workers comp on taxes the answer is no. I deal with all levels of tax planning and controversy - from the ordinary to the complex.

If you withhold New York State New York City or Yonkers income tax from your employees wages you must report it quarterly on Form NYS-45. A business must have an active NYSIF workers comp policy have more workers comp premium or payroll in New York State than in all other states combined and will be subject to NYSIF underwriting review to be eligible for NYSIFs out-of-state coverage. Pay the metropolitan commuter transportation mobility tax MCTMT Resources.

The insurance carrier pays weekly cash benefits and for medical care as directed by the Workers. It provides cash benefits andor medical care for employees hurt on the job or who become ill because of their work. Best Tax Software.

Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. Overview When the Workers Compensation Board issues an award of compensation for a prior year disability period and any portion of the award is credited to NYS the State Insurance Fund sends a C8EMP Info form to OSC. Employers pay for this insurance.

This means you do not have to pay federal or state taxes on them. Partners and LLC must be included at a minimum of 35100 and a maximum of 106600. The IRS in Publication 907 specifically states that workers compensation benefits for job-related sicknesses or injuries are not taxable.

Pay unemployment insurance contributions. Publication NYS-50 Employers Guide to Unemployment Insurance Wage Reporting and. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in the claim process. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

This tax exempt status applies if the worker receives these benefits under a workers compensation act or law. It doesnt matter if your settlement is in a lump sum or structured to pay benefits over a period of time.

What Wages Are Subject To Workers Comp Hourly Inc

Is Workers Comp Taxable Workers Comp Taxes

Workers Comp In New York How The Process Works 2021 Guide

Ny Workers Comp Max Settlement Amounts Paul Giannetti Attorney At Law

Business Index A Z Certificate Of Attestation Basically A Form Saying That I Don T Need Workers Comp Because I Don T Have Em Business Online Business Express

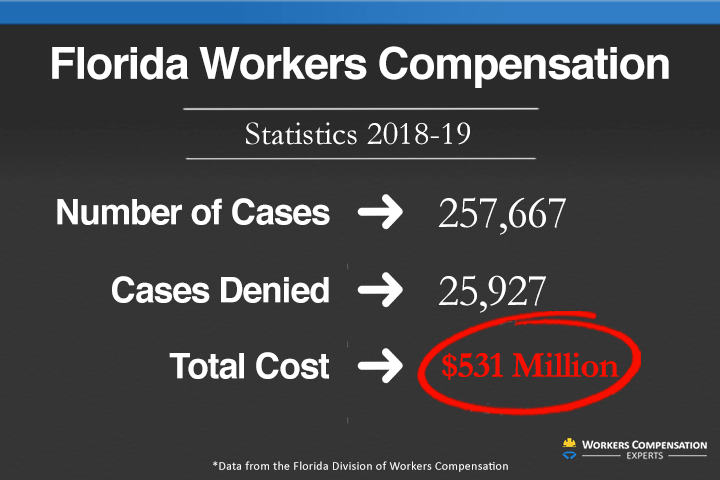

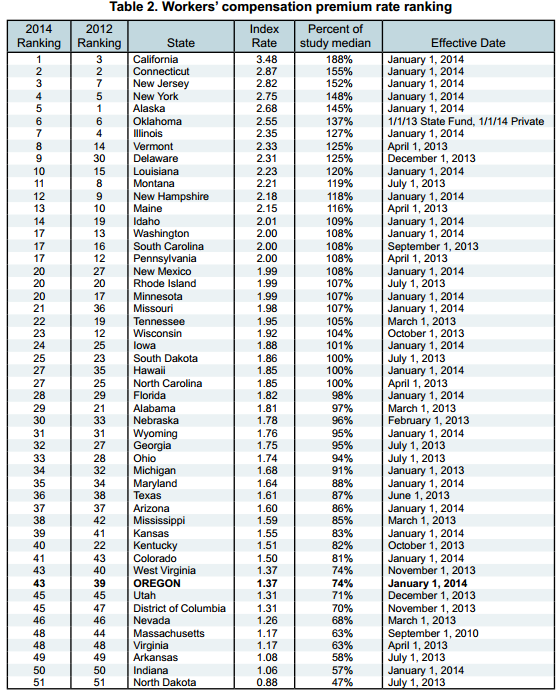

How States Rank High To Low In Workers Compensation Premiums

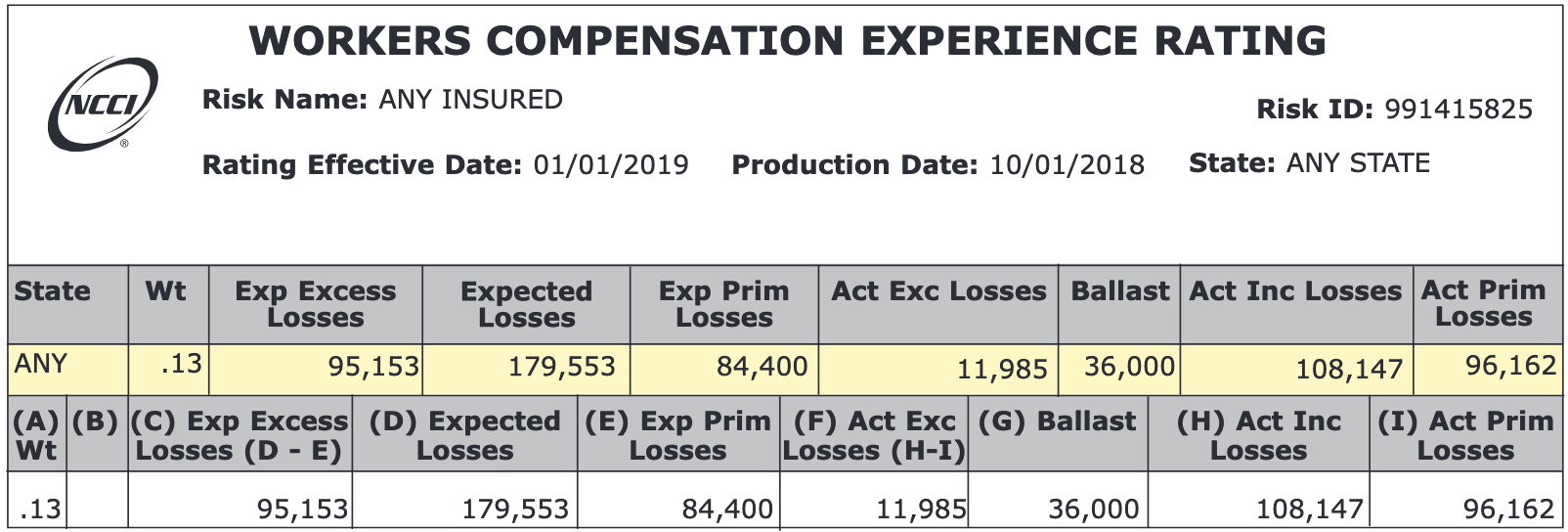

Understanding Your Workers Comp Ex Mod Factor Payroll Medics Payroll Workers Compensation Hr Solutions

Workers Compensation Insurance Overview Amtrust Financial

Ny Workers Compensation C 3 Form Injury Attorney

When Does Workers Comp Start Paying After A Workplace Injury

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Can I Get Disability After A Workers Comp Settlement

Same Day Walk Through Form Stockton Form California Stockton