ui federal tax refund

Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Federal Unemployment Tax Act FUTA taxes are paid entirely by employers who paid at least 1500 in wages during any.

. Income Tax Refund Information. Nowadays you can get your tax refund within 21 days of your tax return. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The IRS has sent 87 million unemployment compensation refunds so far. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160.

New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. It is not your tax refund.

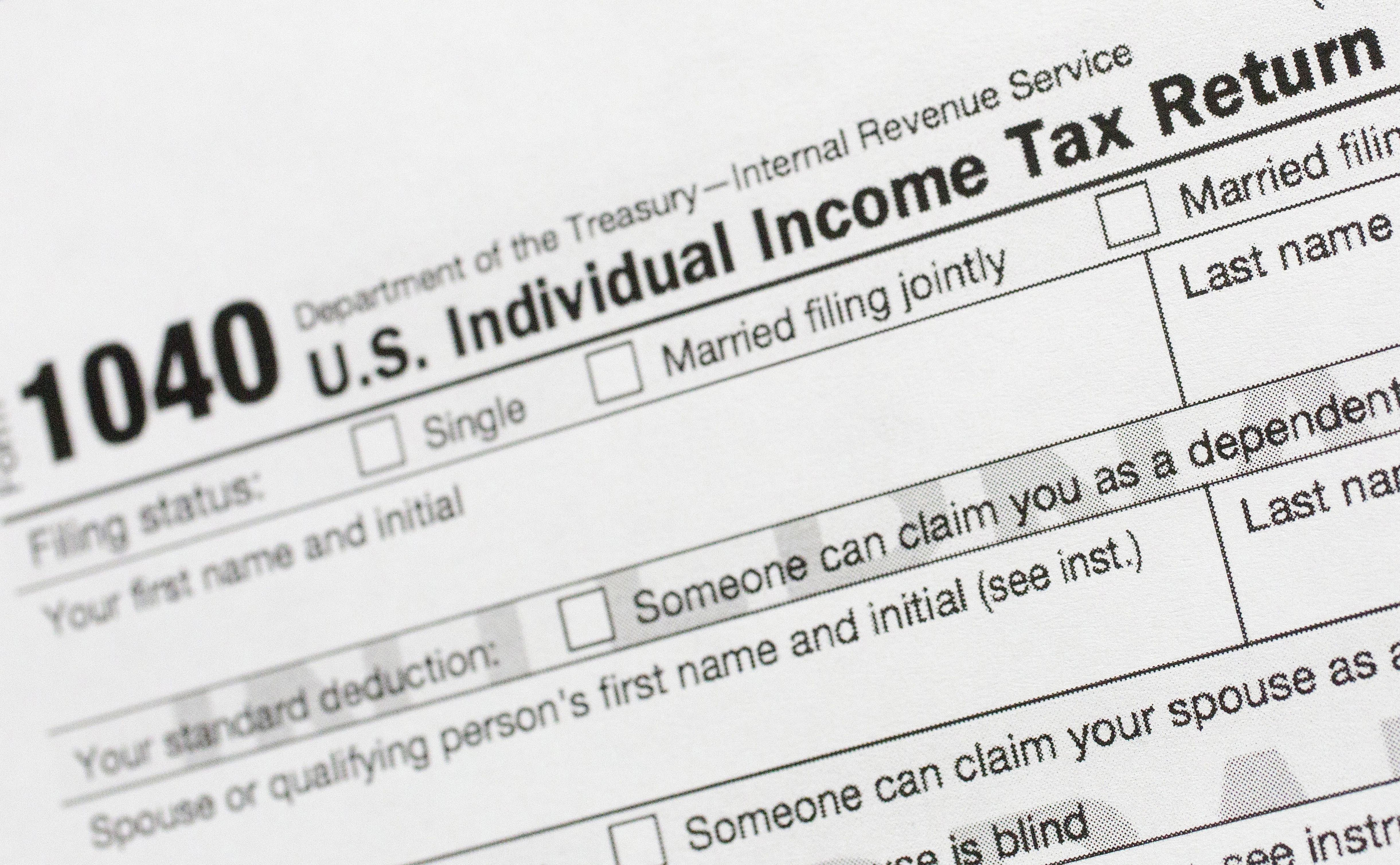

Loans are offered in amounts of 250 500 750 1250 or 3500. Report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section and carry the information to your main Form 1040. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

Total the New York State tax withheld amounts from all IT-1099-UI forms. Using the IRS Wheres My Refund tool. Viewing your IRS account.

This is an optional tax refund-related loan from MetaBank NA. Approval and loan amount. Federal Unemployment Insurance Account Numbers.

Blake Burman on unemployment fraud. Since the introduction of E-filing your tax return the process has paced up. Since a composite return is a combination of various individuals.

Include this total on the Total New York State tax withheld line on your New York State income tax return.

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

Unemployed In 2020 Get Ready For A Big Tax Refund

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Dor Unemployment Compensation State Taxes

Irs Sending Unemployment Tax Refund How To Contact Irs If Missing As Usa

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Are Unemployment Benefits Taxable Wcnc Com

State Conformity To Cares Act American Rescue Plan Tax Foundation

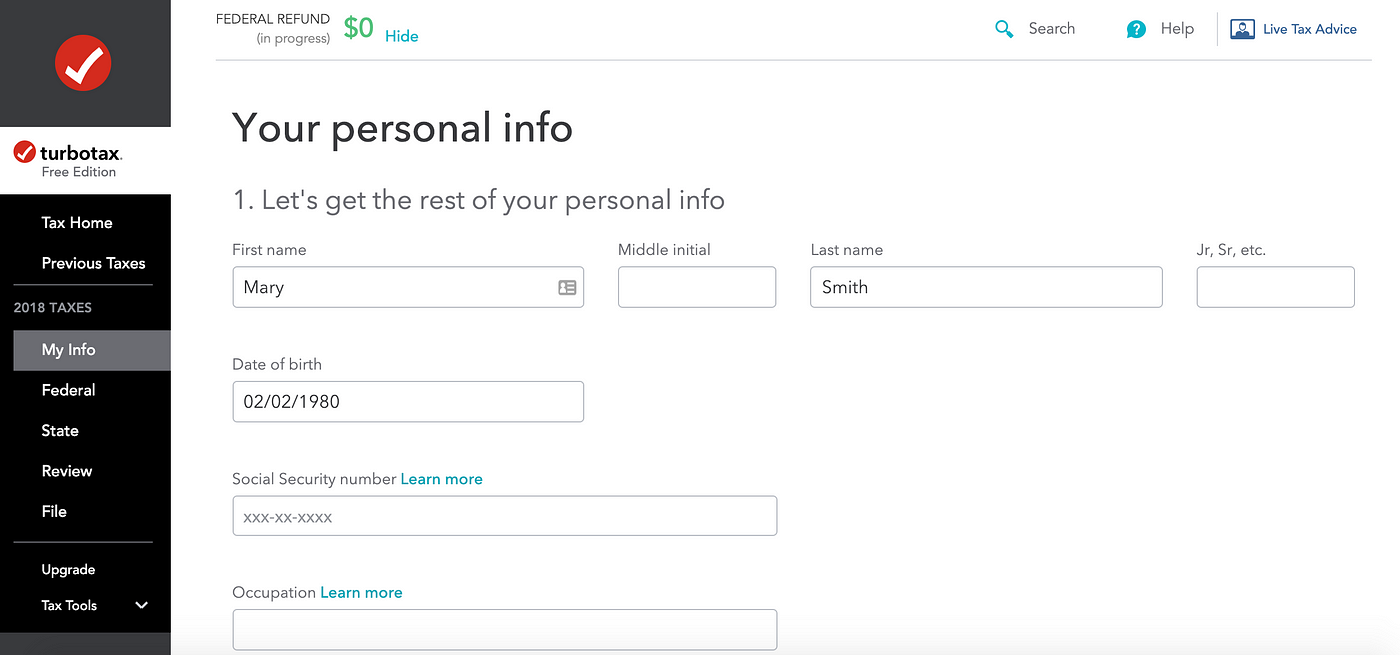

Why I Love Filing My Taxes A Ux Ui Analysis Of Turbotax By Emilia Totzeva Ux Collective

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

It S Here Unemployment Federal Tax Refund R Irs

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

2022 Irs Tax Refund Breaking News Refunds Issued Processing Delays 60 Day Notices Eitc Ctc Youtube

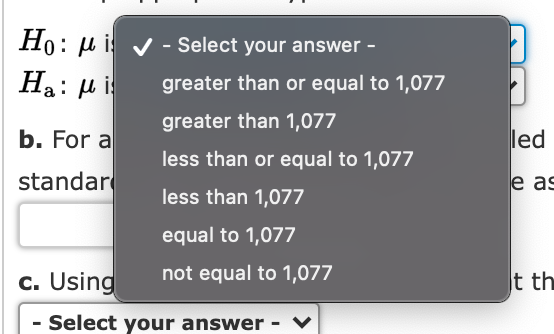

Solved According To The Irs Individuals Filing Federal Chegg Com

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Unemployment 10 200 Tax Break Some States Require Amended Returns